GFOUNDRY SOLUTIONS BY INDUSTRIES

Talent Management in Finance and Banking industry

Why talent management is important in Finance and Banking industry?

In Finance and Banking industry, talent management is particularly important because this industry is facing unprecedented challenges in the modern economy. With digital transformation and changing customer preferences, financial institutions need to adapt to stay relevant and competitive. One of the critical areas that need attention is talent management.

What are the Finance and Banking industry challenges?

The Finance and Banking industry challenges are:

Talent Attraction and Retention The financial services and retail banking industry is witnessing a rapid shift towards digital transformation. This has led to a significant change in the skills and competencies required from the employees. The industry is facing a severe shortage of talent with advanced technological skills such as data analytics, machine learning, and artificial intelligence. The industry’s high employee turnover rate is due to factors such as lack of career progression, job satisfaction, and work-life balance.

Regulatory Compliance Financial services and retail banking are highly regulated industries, and complying with these regulations can be complex and expensive. Failure to comply can result in significant penalties, fines, and reputational damage.

Cybersecurity Financial services and retail banking are increasingly reliant on technology, which makes them vulnerable to cyber threats such as data breaches and cyber attacks. Ensuring the security of customer data and systems is crucial for maintaining customer trust.

Changing Consumer Behaviors Consumer behaviors are changing rapidly, with consumers increasingly preferring digital and mobile channels for banking and financial services. This has led to a need for financial institutions to adapt to these changes by developing digital offerings and improving their online and mobile banking capabilities.

Competition Financial services and retail banking are highly competitive industries, with traditional players competing against new entrants such as fintech startups and digital banks. This has increased pressure on financial institutions to innovate and differentiate themselves in order to attract and retain customers.

Customer Expectations Customers have high expectations when it comes to the quality of service they receive from financial institutions. This includes personalized services, fast and efficient transactions, and transparent fees and charges. Meeting these expectations can be challenging, especially as customer expectations continue to evolve.

Economic Conditions Economic conditions can have a major impact on the financial services and retail banking sectors. Economic downturns can lead to decreased demand for financial products and services, while rising interest rates can make it more difficult for consumers to afford loans and mortgages.

Demographic Changes Demographic changes, such as an aging population and increasing diversity, can create challenges for the financial services and retail banking sectors. Financial institutions need to be able to adapt to these changes and provide services that meet the needs of different demographic groups.

How can GFoundry’s platform help address the Finance and Banking industry challenges?

3: Rapid Technological Advancements

GFoundry’s Learning Management System (LMS) provides customized training programs to employees.

The platform enables the creation and delivery of personalized learning experiences based on the employees’ skills and learning needs. By using GFoundry, employees can upgrade their skills in the latest technologies and tools, which helps financial institutions to stay competitive in the market and more secure, regarding cybersecurity demands. Read more here.

Regarding Onboarding and Adoption of new Software, the GFoundry platform can help you implement an easy-to-use and impactful solution, making your new software adoption easier to achieve. Read more here.

5. Communication breakdowns

This is a major challenge for the security of financial institutions.

Poor communication between employees can result in errors or delays in critical operations, leading to customer dissatisfaction, fines or capital losses.

Financial organizations must develop clear and effective communication channels, including standardized handover processes, to ensure that important information is communicated effectively among the entire internal community.

6. Pulse surveys and feedback

One of the strategies that can combat Job Hopping is constant feedback and listening to employees. In addition to pulse surveys, it is important to present paths and opportunities within the organization.

7. Succession Planning

GFoundry’s platform includes tools for identifying and developing high-potential employees, and for creating succession plans to ensure continuity in key roles. This can help to address the potential impact of employee burnout and turnover.

8. Compensation and benefits

To ensure that your organization attracts the most qualified candidates and retains them with competitive compensation and benefits packages, it is important to understand, beyond compensation, what non-financial benefits each person or group of people values most.

You can use GFoundry’s Comparisons module and allow employees to choose the benefits that suit them best from the benefits available.

9. Gamification

The GFoundry platform includes a powerful gamification engine, which can be used to make various processes more engaging and motivating.

This can be especially useful for employees who may be struggling with disengagement issues, as it can make personal development and career management processes more motivating.

Gamification can offer benefits across multiple human resource processes, allowing you to align, develop and motivate your employees more effectively.

A BUSINESS-BOOSTING TOOL

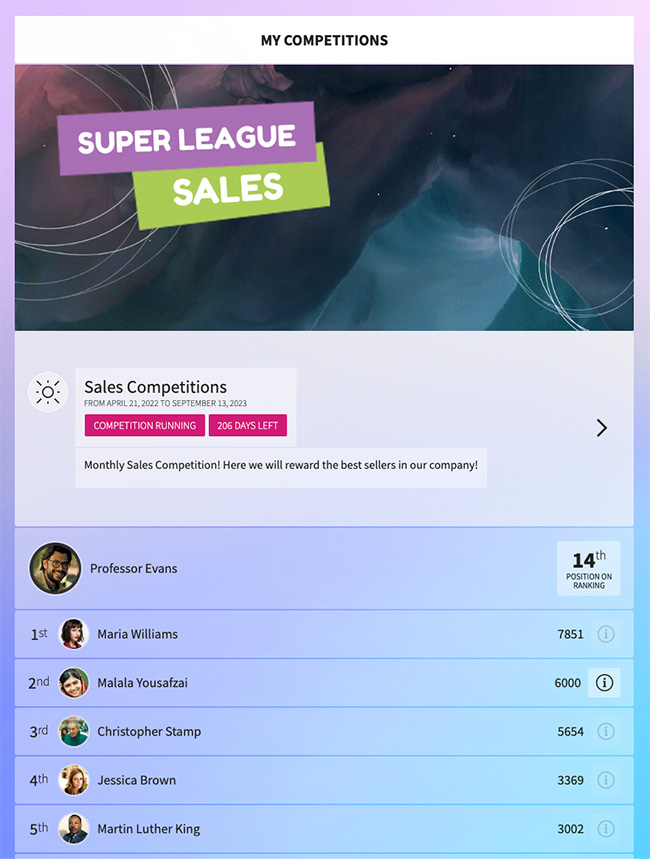

Turn your teams’ KPIs into a game!

With the Competitions module, you can create competitions using your own data, and make your teams more aligned, motivated and resilient, creating individual, tribe or team dynamics.

Commercial Teams

Measure sales, contacts and other objectives. Commercial teams in organisations are responsible for sales processes.

Therefore, their goals are usually linked to sales volume, number of contacts made, number of contracts signed, among other examples.

With GFoundry, you can create monthly sales competitions, where the best performing employees can receive medals and rewards for their performance!

Technical Teams

Measure the performance of support services

In development and support teams, the biggest challenges are linked to solving errors and problems in a given technical structure (better known as troubleshooting).

In order to motivate employees to solve more errors, and more efficiently, with GFoundry you can create competitions for the highest number of errors solved by each employee in a given period, in which you can reward and recognise the employees with the highest performance. This dynamic can have a significant impact on the response capacity that the technical teams can guarantee to their clients.

Call Centers

Measuring the number of contacts and their effectiveness

With the GFoundry platform, you can create competitions for the performance of call center employees by the number of contacts made by each one, or even divided into teams.

For example, the competition may be organised by teams, in which each team gathers the number of contacts made by each individual member of the team. At the end, the team can be rewarded and recognised for its performance, while at the same time allowing for greater interaction between team members so that they can achieve the desired results.

Meet some real use cases in Finance and Banking industry

Knowing real cases helps to understand the potential of the GFoundry platform and shows how some companies have solved and achieved some of their challenges.

Keep on reading:

-

Benefits of a Good Organizational Climate: Productivity and Talent Retention

-

Building Resilient and Adaptive Workforces: A Global Talent Trends Study

-

Talent management platform to boost employee engagement

-

How to Choose the Right Talent Management Platform for Your Business

-

How to Attract, Retain, and Develop Top Talent

-

The Ultimate Guide to Remote Talent Management

-

The Impact of the Employee Value Proposition on Talent Attraction

-

HR Trends: What Will HR Look Like in 2024?

-

How to improve Employee Engagement and Performance? Your Ultimate Guide

-

Employee well-being – the complete guide

-

How to create Impactful Learning Journeys for Employees?

-

Feedback: what it is, its importance and how to do it (complete guide)

-

OKRs – Objectives and Key Results: what they are, what their purpose is and how they can be useful when applied in an agile way

-

What is the importance of Compensation and Benefits for employees?

Ready to get started?

Take the next step and learn more about how GFoundry can help you.